Trusted by 2000+ SME Business Owners

15+ Years of Finance & Compliance Expertise

Practical Templates & Compliance Checklist Included

Trusted by 2000+ SME Business Owners

15+ Years of Finance & Compliance Expertise

Practical Templates & Compliance Checklist Included

Trusted by 2000+ SME Business Owners

15+ Years of Finance & Compliance Expertise

Practical Templates & Compliance Checklist Included

Trusted by 2000+ SME Business Owners

15+ Years of Finance & Compliance Expertise

Practical Templates & Compliance Checklist Included

🚨BREAKING: Practical finance system for SME owners

90-minute masterclass:

Build a Finance Team that Works Without You Build a Finance Team that Works Without You

Stop firefighting in accounts. Learn how to get audit-ready books every month, crystal-clear cash flow, and a finance team that runs smoothly without your daily follow-ups.

Watch the Video

This masterclass is your chance to finally fix your finance function. Join us live and see how a few simple shifts can give you control and confidence in your numbers.

Trusted By Top Companies

Does This Sound Familiar?

Your profit shows on paper, but between delayed receivables, compliance stress, and hidden leaks, cashflow never matches reality.

- You waste hours following up for reconciliations, entries, and simple updates.

- Your statements look healthy, but your bank account tells a different story.

- Errors, mismatches, and losses only appear during audits—too late to fix.

- Deadlines, penalties, and tax issues keep you stuck in stress mode.

- Receivables, stuck stock, and unmonitored advances drain your cashflow.

- You only get raw entries instead of insights on margins, cashflow, or profitability.

- Everything collapses if your key accountant quits, falls sick, or makes mistakes.

- Errors keep surfacing month after month — wasting time fixing instead of planning.

Here’s What You’ll Walk Away With

Instead of endless stress and blind trust, you’ll walk away with clarity, control, and a proven system for your finance function.

Know Exactly Where Cash Is Blocked

Spot receivables, stock, and vendor advances that are draining your cash — and learn how to unlock them fast.

Get Audit-Ready Books Every Month

No more last-minute panic. Your accounts will be timely, accurate, and always in control.

Review Finance in One Monthly Meeting

A simple structure that keeps you updated on profit, cashflow, and working capital in under 60 minutes.

Withdraw Profits With Confidence

Know the exact amount you can safely take out each month without fear of running dry.

Run Your Finance Without Stress

Lead your team like a CFO, without chasing accountants or firefighting deadlines.

Build a Team That Works Without You

Shift from people-dependence to process-driven — your finance team runs like a system, not a chaos.

These are the exact systems we’ve implemented with 500+ Indian SMEs across manufacturing, retail, and services.

❌ Before the Masterclass ---> Chasing accountants, no clarity, stressed cashflow

After the Masterclass ---> Audit-ready books, predictable profits, cashflow clarity

What’s Inside The 90 Minutes?

Clear, practical steps to take control of your accounts, cashflow, and finance team — without theory or jargon.

- Track Every Rupee in Real-Time Spot where money gets blocked — receivables, stock, or vendor advances.

- The Finance Control Framework A simple monthly review system used by 500+ SMEs to manage cashflow and profitability.

- Run Your Finance Without Over-Hiring Structure your team with processes that work, not dependence on one person.

- Withdraw Profits With Confidence Know how much you can safely take out without fear of running short.

- One Monthly Review, Zero Stress Lead your finance like a CFO in just a 60-minute meeting each month.

Upcoming Knowledge Sessions

Choose a topic that fits your business needs. Most sessions are free, live, and packed with value.

WIN YOUR 2026

This is a Structured Planning Session to help business owners set realistic goals and stay consistent in 2026 using 5

Decode Your FSS: 5 Powerful Metrics Every SME Must Track Monthly

Get complete clarity on your numbers, cash flow & business health — without being a finance expert.

💡Balance Sheet Revealed

Join us for an eye-opening live session where CA Sajal Goyal breaks down how to truly understand your balance sheet

Download Free Toolkits

Register now and get access to the free toolkit!

Free Resource for SME Owners

Get the first 2 chapters of our book “Finance Control Framework” — absolutely free. Learn the exact system SME owners use to stay cashflow positive.

- Learn why profits on paper ≠ cash in the bank (and how to fix it)

- Discover 3 key reports every SME must track monthly

- Get a proven system to control working capital & unlock stuck cash

- Uncover the hidden leaks draining your profits — and plug them fast

- Simplify your finance process so your team spends less time on accounts and more on growth

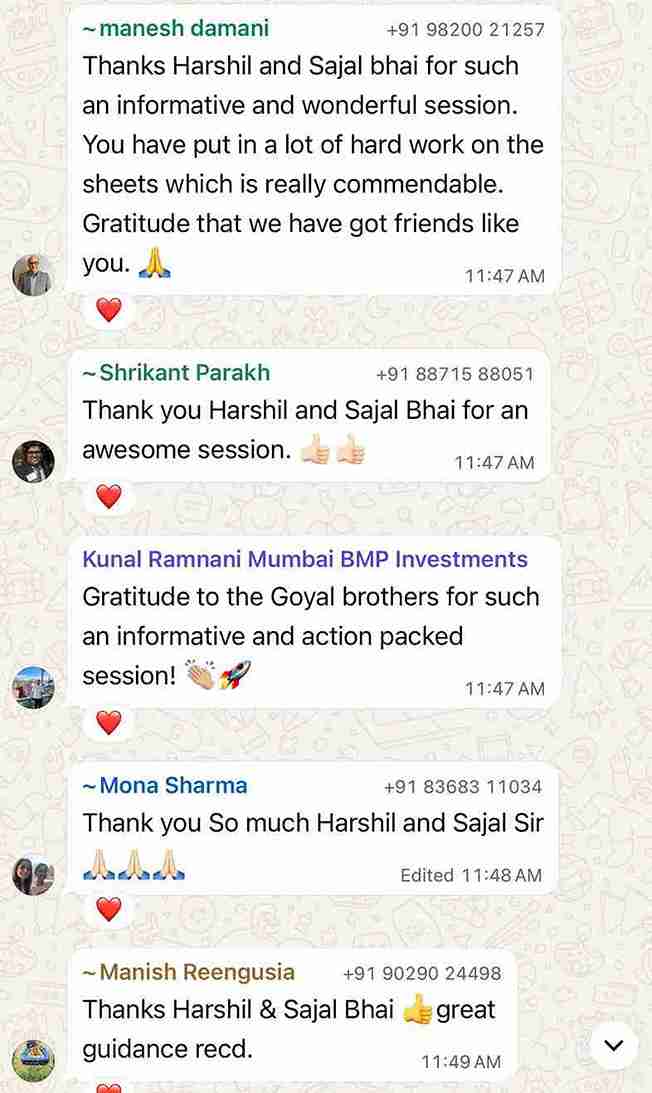

See What 100's of Founders and Business Owners Say about our webinars

Meet Your Mentors Meet Your Mentors

CA Sajal Goyal

Sajal Goyal is a seasoned Chartered Accountant with over 20 years of experience in finance, taxation, compliance, and strategic business consulting.

Over the years, Sajal has worked closely with more than 500 businesses across manufacturing, D2C, retail, service, and technology sectors. His approach blends deep financial expertise with practical business understanding – enabling founders to make confident decisions, manage cash flow effectively, and build long-term value.

Known for simplifying complex financial concepts into easy-to-implement systems, Sajal is widely respected among his clients as a trusted advisor who brings both clarity and accountability to the table.

CA Harshil Goyal

Harshil Goyal is a seasoned Chartered Accountant with over 16 years of experience in Valuation, Transaction Advisory, Reporting, and strategic business consulting. As a Registered Valuer and an expert in Mergers & Acquisitions, Harshil has successfully led valuations for more than 200 companies, helping businesses unlock their true potential.

With a sharp focus on growth and valuation, Harshil partners with entrepreneurs and management teams to design strategies that not only strengthen their financial systems but also enhance long-term enterprise value. His strength lies in combining technical depth with a forward-looking perspective—ensuring that every financial decision contributes to the bigger vision of sustainable growth.

Trusted by business owners for his clarity, precision, and actionable insights, Harshil has built a reputation as an advisor who brings both structure and momentum to businesses navigating expansion, fundraising, or strategic transitions.

Our Journey: From a Small Town Shop to Empowering 250+ SMEs

- Started from a small kirana store in Sikandrabad.

- Chose Chartered Accountancy as the path to financial expertise.

- Quit corporate (Honda) in 2014 → built our own practice from scratch.

- First client from Noida Phase 2 → grew through referrals.

- From giving our first employee just a register → today 100+ team members strong.

- Coached & served 250+ SME clients across India.

- 2.2x revenue growth & 3.1x profit growth after Business Coaching India mentorship.

- Vision: help 1,00,000 SME owners achieve clarity, exit plans & scalable value.

We’ve lived the struggles of running a business, and that’s why we help founders like you gain freedom, clarity, and control.

AS Seen In

Trusted. Recognized. Endorsed

Why hundreds of SME owners and leaders choose to work with Sajal & Harshil

Rahul Jain — Pioneer of Business Coaching in India — endorses Sajal & Harshil for giving entrepreneurs financial clarity and control.

Trusted by Business Owners Across India

Launching Business Ka Financial Mirror

Our book is not just theory — it’s a hands-on workbook designed to give SME owners clarity about profits, cashflows, and financial control.

Here’s What Other Business Owners Are Saying

From cash flow struggles to audit-ready systems, see how SME founders transformed their finance with Especia.

"Sajal bhai dariya hai financial wisdom ka . Jitna seekh sakte ho, seekh lo - it’s 100x worth it. My entire perspective towards the accounts department has changed. Earlier, I used to just ask the accountant, “Sab theek hai? Tax bhar diye?” - and that was it. Now, I actively monitor key parameters I learned during this program. They’ve truly been game changers. Result is profit grown to 2.2x this year."

"I run a bakery chain, and honestly, I feel most of us don’t really know what to monitor in the accounts department. I was the same, my complete focus used to be on the revenue growth overall. I used to think I was growing, but in reality, I wasn’t. After doing the FCM Program, I gained clarity on Cost Center-wise profits, Withdrawable Profits, 5 key reports to monitor, and 10X more valuable insights. fantastic journey. By implementing what I learned, I was able to 1.5X my profits almost immediately."

"Sajal Bhai, thank you so much for all the valuable insights you shared during FCM. I always used to struggle with understanding why there was profit in the books but not in the bank. Your Book to Bank report was truly a game changer for us. It helped us shift our focus to what really matters. Grateful for everything you've done – thank you once again!"

"Sajal Bhai, thank you so much for all the valuable insights you shared during FCM. I always used to struggle with understanding why there was profit in the books but not in the bank. Harshil Ji & Sajal Ji has given us the confidence to scale our business. The best part is that their vibes match with ours – they truly understand what we want. And honestly, that’s the best growth strategy one can ask for.

“Harshil Sir and team truly understand how a start-up works. We feel blessed to have them with us since day one. Till now, the Especia team has seamlessly managed our finance & accounts function, secretarial work, and all day-to-day requirements. The best part is that they are prompt, understand our expectations, and consistently go beyond them."

Monthly reporting by Especia has truly become the backbone of our growth. Their clarity in numbers and timely insights give us confidence in every decision we take. With their support, we’re not just keeping track of our finances—we’re building a stronger, more scalable business. What we like most is their proactive approach and the way they explain complex financial data in simple words. It feels like having an extra finance partner in our own team.

We partnered with Especia in early 2023 when our growing business needed a reliable accounting partner. Their team quickly understood our needs, built SOPs, and streamlined processes, taking a major operational load off our shoulders. This has allowed us to fully focus on our core business—helping B2C companies grow. Especia’s flexibility, use of digital tools like Google Drive and WhatsApp, and their startup-friendly approach make them an excellent choice. I truly value the partnership and look forward to continuing this journey together.

“My experience with Especia has been nothing short of outstanding. As Director at KHvatec India, I’ve worked with many vendors over the years, but the team at Especia really stands out. From day one, they demonstrated exceptional professionalism and a deep understanding of our needs. I wholeheartedly recommend Especia to any company looking for a supplier who delivers on promises, values collaboration, and brings consistent value to the table.”

Frequently Asked Questions

We know that managing business finances can often feel confusing and stressful, so we’ve put together answers to the most common questions SME owners ask us about the webinar.

It’s designed for SME business owners, founders, and decision-makers who want better control over accounts, cash flow, and profits.

Absolutely. The framework is explained in simple, practical steps — no jargon. Many non-finance founders use it successfully.

This is a live workshop. We encourage you to attend live to get the most value. A limited-time replay may be shared only with registered attendees.

You don't need your team your team to join . All our Sessions are beginner Friendly

You’ll learn how to:

- Get audit-ready books every month

- Track cash, profit, and working capital easily

- Build a finance team that works without you chasing them

Yes. Cash flow, compliance, and finance control challenges are the same across industries — whether you’re in manufacturing, retail, D2C, or services.

This is a free value-first session. We’ll share how you can work with us if you want deeper implementation, but the 90-minute webinar itself is actionable on its own.

Once you register, you’ll receive the Zoom link and reminders on email/WhatsApp before the session. Just click and join at the scheduled time.